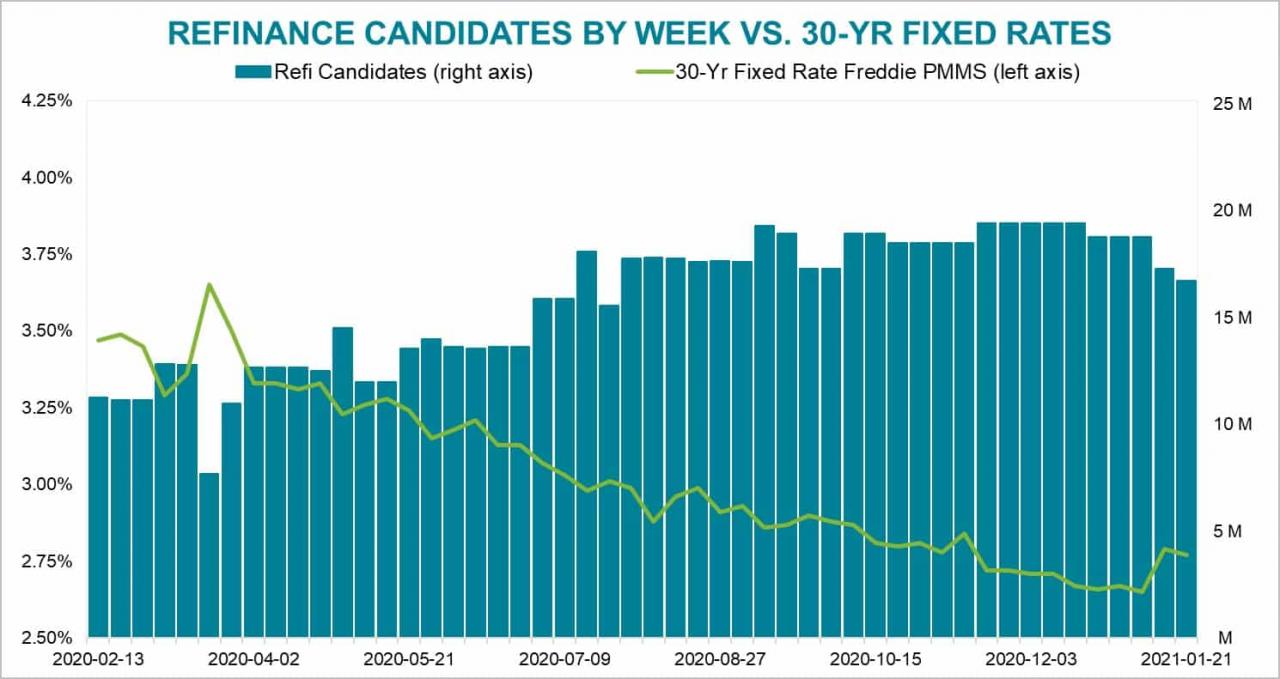

Even as interest rates begin to tick up from the historic lows we have observed in current months, refinance incentive stays powerful in today’s marketplace. As of Thursday January 21, Freddie Mac was reporting the regular 30-yr conforming mortgage loan interest rate at 2.77%. This mainly aligns with the more timely monitoring of our own Optimal Blue Mortgage Market Index (OBMMI), even though its everyday measurement confirmed costs a bit larger by the time the Freddie Mac introduced the week’s average.

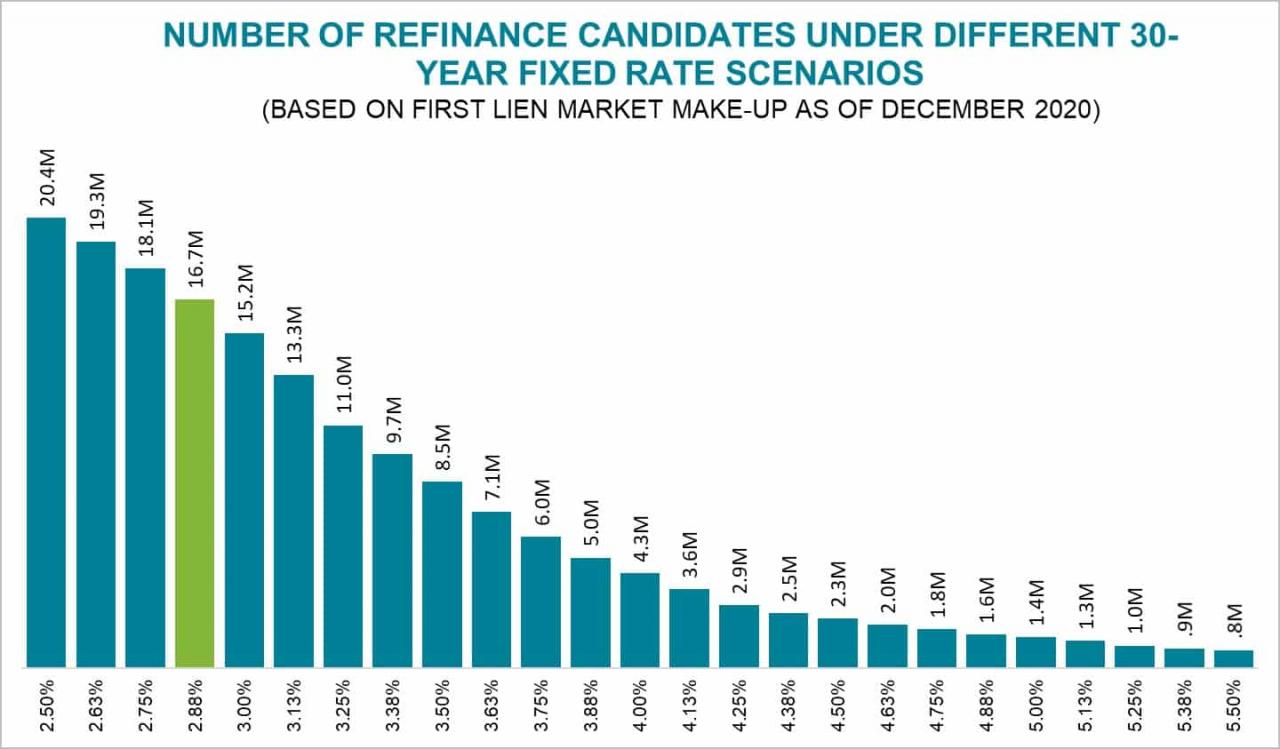

In any circumstance, as costs passed the 2.75% threshold, the population of high-quality refinance candidates declined, but to a nevertheless traditionally huge 16.7 million. This is earlier mentioned and over and above the far more than nine million individuals who refinanced in 2020.

As a reminder, We outline refinance candidates as individuals 30-yr home loan holder who are present on their mortgage loan payments, have at minimum 20% equity in their houses and credit scores of 720 or greater, and who stand to lower their initial lien fascination fee by at minimum .75% through a refinance.

Ought to costs slide to 2.75% or under when yet again, the population would climb back again to 18.1 million. If costs carry on their upward pattern and cross the 2.88% threshold, 1.5 million individuals would drop refinance incentive.

In total, the 16.7 million refinance candidates could conserve an mixture of $5.1 billion for every thirty day period if absolutely everyone took advantage of today’s costs. That functions out to an regular of $305/month for every property owner. Some 3.8 million are in the situation to conserve $400 or far more for every thirty day period. All collectively, this could surely act as an financial stimulus of kinds specifically welcome as the U.S. attempts to discover its way out of the COVID-19 pandemic and its numerous damaging financial impacts.

The 10 premier states by populace account for nine.two million of the complete populace, with California observing significantly and absent the finest solitary-condition mixture regular monthly cost savings. At just above $one billion, that is about equal to the cost savings of the up coming 3 premier states mixed.

| State | Refinance Candidates | Avg Savings Per Borrower | Total Monthly P&I Savings |

| CA | 2,492,000 | $415 | $1,034,038,000 |

| FL | 1,226,000 | $265 | $324,773,000 |

| TX | 1,154,000 | $260 | $300,040,000 |

| NY | 976,000 | $415 | $405,008,000 |

| IL | 677,000 | $275 | $186,192,000 |

| PA | 555,000 | $264 | $146,424,000 |

| NC | 552,000 | $254 | $140,238,000 |

| VA | 548,000 | $345 | $189,015,000 |

| OH | 547,000 | $216 | $118,095,000 |

| NJ | 529,000 | $367 | $194,283,000 |