Alongside with the relaxation of the economic climate, the housing marketplace has been working with the fallout of a international pandemic, top to an unsure “new norm.” In a HousingWire panel on Tuesday, Rohit Gupta, CEO and president of Genworth House loan Insurance policy, and Tom Wind, govt vice president of customer lending at U.S. Lender, talked about adapting to unexpected winds of modify and how to target on what is subsequent.

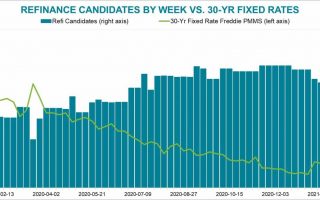

In a common economic downturn, Gupta observed, enhanced unemployment and absence of customer self-assurance sluggish the marketplace as delinquencies increase and origination quantity commences to decrease. But 2020’s pandemic threw that craze out the window. With file higher unemployment in April and enhanced delinquencies that could very last via 2022, minimal fascination prices brought on sound originations for practically 6 months – and organizations pivoted rapidly.

“We experienced to refocus our attempts, the two from an power standpoint, and from our assets standpoint. Our target grew to become the two placing individuals in houses on the entrance stop so our buyers have been effectively positioned to shut financial loans and then also on the servicing aspect, to make positive that we have been having treatment of people that have been encountering monetary troubles and have been in forbearance or delinquency,” Gupta explained.

In a increase cycle, nonetheless, Wind explained it can turn into much more tempting to satisfy every single bank loan feasible. In accordance to Wind, keeping in advance of the quantity consists of much more than just completion – developing a effective group, electronic adoption, client engagement and automation need administration previous a sturdy period.

“The working day will occur, and it is not that much off, when issues commence to sluggish down and if you are not considering about the long term, and investing in the long term, when that subsequent working day arrives, you are heading to be on the exterior hunting in in conditions of aggressive place,” Wind explained. “I believe as a lot as you want to get edge of nowadays, specifically for the leaders of the business, be considering of tomorrow.”

In a interval of disaster, the two experts have been in arrangement that a sturdy group will stick to the knowledge as much down the rabbit gap as feasible. From prices, to purposes, to secondary unfold and forbearance – paying out consideration to traits offers organizations enough time to put together.

“So when we commence having steps on what we are considering about threat in the marketplace, all people has the very same look at on what is the appropriate point to do, and what could be the dangerous point to do,” Gupta explained.

“We have recognized groups that in fact go throughout our company making use of equipment like device understanding, which in fact seem at our forbearance knowledge and then parses that forbearance knowledge down to characteristics. What characteristics are top to increased forbearance? To reduce? So then the underwriting group is mindful of it, the pricing group is mindful of it, threat group is mindful — all the way to the business group from advertising and marketing and product sales.”

What can the market anticipate in the remainder of the fourth quarter? To Gupta, that is the “$one.eight trillion question” – an homage to the stimulus supply President Trump signed off on Oct. nine. The CEO explained his group is “cautiously optimistic” and not nevertheless prepared to declare victory in conditions of financial or COVID-19 traits, although a next stimulus could support buffer an additional downturn.

Gupta observed that if Biden wins the election, apart from the feasible initial-time homebuyer tax credit score, the dialogue would change from money specifications to inexpensive alternatives along with an expanded market target on rising homeownership and better alternatives for reduce FICO scores.

“I’d say a brilliant location for lending and housing is no matter of who wins the election, from a fee-surroundings standpoint, the require to market the economic climate and its expansion will prevail. It is tough to image prices leaping up at this stage significantly,” Wind explained.

Apart from no matter whether the White Property stays crimson or goes blue, Wind explained because the 2008 monetary disaster, the federal government has evidently witnessed how crucial housing is to restoration, and in change, the market has witnessed how crucial a federal government backstop is.

“I believe it’ll be a good deal of dialogue on how large that backstop need to be and how Fannie and Freddie are structured. But basically producing positive that there is ongoing liquidity to housing finance, I believe you are going to discover wide arrangement throughout the two sides of the aisle,” Wind explained.